PGP in Banking Financial Services and Insurance

- Banking and Finance Courses, Certification Courses

- 1065 (Registered)

Lead the financial revolution through SkillSchool’s Post Graduate Program in Banking, Financial Services, and Insurance. Make your mark in the financial services platform by endorsing our modern pedagogy and immersive curriculum to become a competitive performer.

Accelerate your career in the BFSI Sector by upskilling with SkillSchool’s Postgraduate Program in Banking Financial Services and Insurance. We are committed to delivering impactful training and learning for individuals aiming to hone their skills in financial transactions, the security market and Insurance services, for a strong career foundation. At SkillSchool you will attain an all-round development and you will be ready to face your job interview as you build an in-depth knowledge of the BFSI concepts.

Duration: 4 Months Live Online Classes: Interactive one on one Learning

Weekend classes

60 Hours focus on Course Module and 40 Hours of Capstones, Soft skills training, and interview preparation

Beginner-Friendly Level: Fresh Graduates can also join

Industry-experienced trainers: Learn from the best with extensive experience in their respective field

Industry-Based Curriculum: Course modules tailored to the banking, finance, and insurance sectors by blending the latest trends

11 Modules with key topics: Learn the key areas in Banking, Finance, and Insurance

24/7 Assistance

Soft Skills Training: Overall skill development

Job Preparation Support: Resume writing activities, and Mock Interviews

The SkillSchool’s PGP in Banking Financial Services and Insurance is your one-stop solution where you build competencies not just in theoretical concepts and technical tools, but also earn the proficiency to put your knowledge into practice at your job. The course nurtures the essential skills to enhance employability in the rapidly evolving job market.

Program Overview

Gain a comprehensive understanding of modern banking and finance, Security Markets and the Insurance Industry by enrolling in the Skillschool PGP in Banking, Financial Services and Insurance. The course explores the fundamental topics and trending practices across Banking and Finance, Security Markets, and Insurance Sector. Students in the program can expect to immerse themselves in a rigorous learning environment led by experienced and well-qualified faculty. Bringing an in-depth study of the wide-ranging core concepts and practices of Banking, financial services and Insurance, the program explores a comprehensive curriculum designed to meet the needs of various job roles across the BFSI sector.

The program curriculum strongly emphasizes practical skills, ensuring learners acquire the knowledge and tools necessary to effectively tackle challenges in the BFSI Industry and solidify their long-term career goals. Learners can expect to develop critical thinking and decision-making abilities essential for smooth career growth in today's rapidly evolving financial ecosystem.

SkillSchool offers this program to nurture and train the next generation of competent professionals in the BFSI Industry. Join the PGP in Banking, Financial Services and Insurance and earn job-effective skills across the various facets of the BFSI sector and excel in your career.

Join the PGP in Banking & Finance to drive innovation in the digital banking sector. Students can expect to gain industry-specific knowledge and gear up for practical challenges. Our program is designed to meet the evolving demand of the Banking and Finance Industry.

Course Content

Postgraduate Program in Banking and Finance Curriculum

Module 1- MS Excel

Basic & Advanced Excel functions (including Power Query, Power Pivot, and Excel Macros for automation) |

Key functions & formulas used in analysis (Data Analysis, Data Visualization, Conditional Formatting) |

Techniques for budgeting, financial modeling, and decision-making (Excel’s integration with Power BI and real-time data analytics). |

Module 2- Economic System

What is the economic system? (Effects of globalization, AI, and the gig economy on financial institutions) |

Characteristics and impact on finance and banking (Focus on post-COVID economic adjustments, inflation, and stimulus responses) |

Relationship between economics and financial institutions (Highlight fintech’s influence on traditional institutions) |

Overview of the fintech landscape, Collaboration between banks and fintech firms (partnerships, co-innovation) |

Role of financial institutions in different economic systems (Discuss the rise of decentralized finance, blockchain, and cryptocurrencies) |

Decentralized Finance (DeFi) and its impact on traditional banking |

Module 3- Banking System in India

Structure of Indian banking system (Incorporate trends in open banking, API-based services) |

Evolution of the Indian banking (Highlight post-liberalization banking reforms, digitalization efforts) |

Different types of banks in India and the Role Played by them in the Indian Banking System (Focus on neobanks, payment banks, and small finance banks, Incorporate the rise of fintech companies as quasi-banks) |

Factors driving banking structure and its performance (Impact of UPI, digital wallets, and government-led digitalization initiatives) |

Regulatory authority governing the banking system (Explore the push for data protection laws, GDPR, and cybersecurity) |

Contribution of Indian banking system towards economic development (Incorporate digital inclusion, financial literacy programs) |

Module 4- Functions of Banking, Central Bank & Regulation

Primary, Secondary and Ancillary functions of banks (Include the rise of embedded finance in non-financial industries) : Ancillary functions: wealth management, payment processing, risk management (Discuss robo-advisory, AI-driven risk assessment tools) |

What is the central bank and its roles (Currency issuance (Explore digital currencies, central bank-backed digital currencies (CBDCs)) ) |

Monetary policy (Highlight recent trends like quantitative easing, interest rate adjustments) |

Regulatory powers and supervision (Include emerging issues like digital asset regulation, AML advancements) |

Tools for controlling interest rates, money supply (Discuss real-time payments, real-time gross settlement systems), Introduction to blockchain technology and its applications in BFSI (smart contracts, cross-border payments) |

Module 5- Digital Banking ,Mobile Banking and Cloud Computing

Concept of digital banking (Shift to the API economy): Open Banking & Banking as a Service (BaaS) : Open banking is reshaping how financial data is shared, while BaaS is enabling non-banking firms to offer financial services. |

Mobile banking, its development and adoption (Focus on UPI-based transactions, AI-powered mobile banking apps):Features of mobile banking (Include biometric security features and AI-based customer support) |

Shift from traditional banking to digital banking (Discuss customer-centric models, neobanks, and fintech challengers) |

Technological methods for delivering banking services (AI, cloud computing, blockchain, and RegTech) Types of Digital Banking and fintech innovations (Focus on blockchain and decentralized finance (DeFi)), Benefits and challenges of digital banking (Impact of big data analytics, AI-driven decisions) Influence of mobile banking on customer engagement (Personalized user experience driven by AI and data analytics) |

Security concerns, corrective measure and challenges (Focus on advanced threat detection, cybersecurity protocols, Discuss emerging threats like deepfakes, identity theft, blockchain-based security) |

Digital Transformation in BFSI (Beyond Digital Banking): While digital banking has been covered, digital transformation extends beyond banking services into operations, back-end processes, and customer engagement: Digital transformation strategies for traditional banks |

Role of AI and Cloud Computing in BFSI (Cloud computing in enhancing customer experience,Cloud-based solutions being rapidly adopted to ensure scalability and flexibility in banking operations: Cloud computing and its applications in BFSI (core banking, data storage) |

Module 6- Risk Management, Audit & Compliance

Types of risks and frauds (Cyber risks, digital fraud, cryptocurrency risks) |

Preventive measures and vigilance (Discuss advanced machine learning-based fraud detection) and Document verification websites (Incorporate blockchain-based document verification tools) |

E-surveillance and data capturing (Discuss AI-driven surveillance systems, predictive analytics) |

Audit and compliance (Explore continuous auditing) |

Prevention of cyber crimes and fraud management (Discuss biometric authentication, blockchain-based fraud prevention) |

Machine learning in risk management, loan underwriting, and algorithmic trading , Predictive modeling for risk management and fraud detection |

Module 7- Financial Products

Types of financial products (Incorporate cryptocurrency, DeFi products, green bonds) Growing focus on environmental, social, and governance (ESG) factors in financial markets and their integration into banking and financial services , and the rise of green finance in the form of Green bonds and other sustainable financial products) |

Matching products with customer needs (Use AI-driven product recommendations, personalized financial planning) |

Regulatory compliance and consumer protection (Discuss RegTech and evolving regulations surrounding digital assets) |

Cross-Border Payments and Financial Inclusion: With advancements in payment technologies, cross-border transactions and financial inclusion have become key priorities: Innovations in cross-border payments (blockchain, cryptocurrency), Financial inclusion efforts through digital banking and fintech innovations |

Module 8- Banking Sales & Relationship Management

Techniques for selling banking products (Incorporate digital marketing and AI-driven CRM tools) |

Strategies used for effective banking sales and client retention(Include hybrid banking models, cross-channel marketing) |

Customer relationship management (AI-driven CRM, personalization of services) & Cross-selling and upselling (Explore AI-driven insights for cross-selling and upselling) |

Customer Data Analytics & Big Data in BFSI: Big data analytics is helping financial institutions derive insights into customer behavior, risk management, and product customization: Role of big data in customer segmentation, personalized banking services, Predictive analytics in customer behavior and financial planning |

Module 9- Regulatory Bodies & Guidelines

Regulatory bodies: RBI, SEBI, IRDA, PFRDA (Include recent regulatory changes for fintech, cryptocurrencies, and digital payments) |

Understanding CIBIL, credit rating agencies (Discuss AI-powered credit scoring, alternative credit assessment tools) |

Module 10- KYC & Compliance

Concept of KYC and its importance (Focus on e-KYC, AI-powered KYC) and Legal and regulatory framework surrounding KYC (Include digital identity frameworks, privacy laws) |

Procedures for AML and KYC & Blockchain-based KYC, AML, and fraud prevention (Biometric Identification) and Regulatory role in preventing financial crimes (Incorporate RegTech, real-time transaction monitoring) |

RegTech (Regulatory Technology): RegTech is emerging as a solution to help financial institutions comply with regulations more efficiently using technology: Overview of RegTech solutions in BFSI (compliance automation, real-time monitoring) |

Applications of AI and big data in regulatory reporting and compliance, RegTech’s role in anti-money laundering (AML) and counter-terrorism financing (CTF) alongwith AI applications in fraud detection, credit scoring, and customer service |

Cybersecurity in BFSI: As banking moves increasingly to digital platforms, the threat of cyberattacks is growing: Current cybersecurity threats in BFSI (ransomware, phishing, and identity theft) |

Advanced security solutions (AI in cybersecurity, blockchain for secure transactions) , associated Regulatory aspects of cybersecurity and data privacy |

Impact of COVID-19 on BFSI: The COVID-19 pandemic has accelerated digital adoption and shifted financial priorities: Impact of COVID-19 on banking and financial services (digitization, remote banking, Changes in customer behavior and risk assessments post-pandemic) |

Module 11- Soft Skills (Grooming session)

Soft skills training (Focus on digital communication, remote client management, adaptability to tech changes) |

- Key Features

- Requirements

- Target Audiences

Intensive live Online Program

Engage in a dynamic, virtual learning experience designed to train you for competency in the BFSI Industry.

4 Months

Benefit from 4 months of focused instruction, carefully structured to maximize your learning.

Customized Program

Students will learn through self-paced and progressive learning from a team of experts.

Industry-Curated Curriculum

Curriculum developed through collaboration between academia, industry leaders, and skilling partners, to ensure comprehensive learning

Cutting-Edge Tools and Techniques

Our program integrates contemporary methodologies to keep students at the forefront of industry practices.

Hands-On Industry Projects and Expert Mentorship

Engage in real-world industry projects and benefit from personalized mentorship.

24/7 Learning Management System (LMS) Support

Enjoy round-the-clock access to our Learning Management System, which supports your educational journey with additional resources.

Tailored Workshops to Match Your Skill Level

Participate in customized workshops designed according to your proficiency level.

Flexible Learning with Live and Recorded Sessions

Take advantage of a blend of live classes and recorded lectures, offering flexibility to fit your schedule.

Critical skills Incubation

Develop crucial skills through hands-on practice and targeted exercises that reinforce your understanding of key concepts.

Prospective candidates to the Postgraduate Program in Banking, Financial Services, and Insurance at Skillschool are required to fulfil the following conditions:

- Bachelor’s degree or equivalents in a relevant field from a recognized university.

- Minimum of 50% in their graduation.

- Must have a minimum of 50 % in their X and XII grade.

- Work Experience is a bonus.

- Must be in between 21-28 years of age.

- Finance/ Commerce/ Economics Graduates: Seeking advanced level knowledge of Banking and Finance to enhance career prospects.

- Aspiring Retail Bankers: Beginners looking to embark on a retail banking career.

- Financial/Banking professionals: Seeking to advance in specialized roles and positions in banking and financial institutions.

- Entrepreneurs: Seeking to scale and better manage business and intelligently navigate the landscape of the banking and finance sector.

Program Outcomes

Developed a thorough grasp of core concepts in banking, insurance, and financial services to build a strong foundation in the Banking, Financial Services, and Insurance (BFSI) industry.

Acquire advanced technical skills and analytical capabilities to enhance decision-making and tackle complex challenges effectively in the rapidly evolving BFSI landscape.

Ability to execute various functions efficiently across diverse job roles ensuring efficient and accurate handling of financial transactions and services.

Proficiency in assessing and evaluating projects for banks and financial institutions to ensure successful outcomes and strategic alignment.

Deepen your knowledge of operational processes and practices within banking, insurance, and financial services, with a strong emphasis on ethical considerations and best practices.

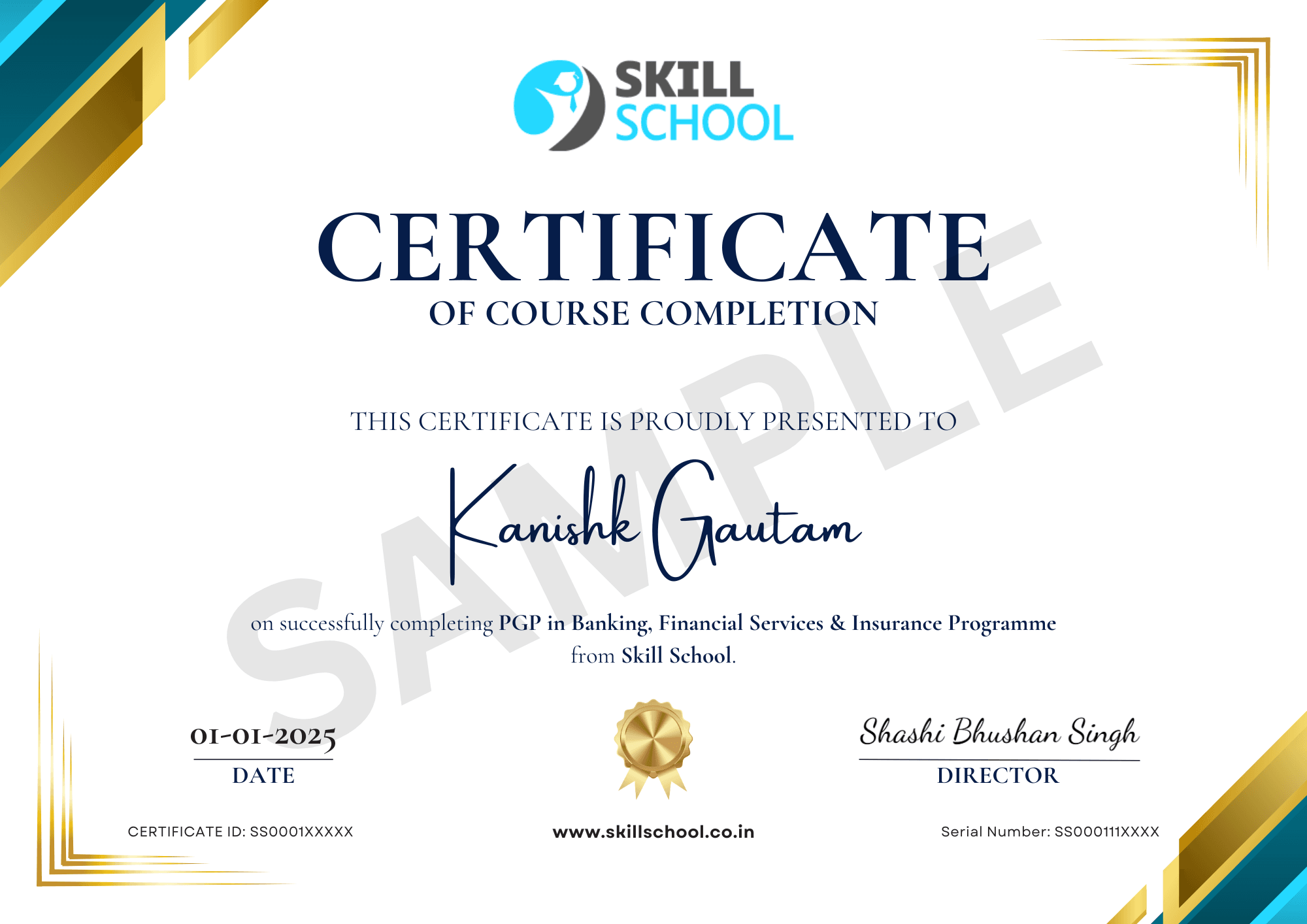

sample certificate

Become a Certified Banking Professional

Program FAQS

The Post Graduate Program in Banking Financial Services and Insurance (PGPBFSI) is an intensive, 4-month curriculum designed to provide a comprehensive understanding of the various facets of the BFSI industry. This program aims to prepare participants for the diverse challenges of working in the BSFI Industry by covering both technical and non-technical elements. Students will acquire in-depth knowledge of banking operations, bank credit, insurance policies, loans, legal frameworks, etc that govern the BFSI sector.

Skillshool offers a Post Graduate Program in BFSI to nurture the next generation of competent financial, banking and Insurance professionals. This program not only enhances students’ technical and managerial competencies but also enhances practical banking, finance and insurance skills. The institute focuses on nurturing and training individuals to excel in various facets of the BFSI sector. Enrolling in Skillshool’s Post Graduate Program in BFSI is a strategic step toward launching a successful career in the BFSI industry.

The BFSI industry is among the largest employers in the country. Completing the PGP in BFSI will open doors to the most exciting professional paths, like the following:

- Accountant

- Financial analyst

- Financial manager

- Investment Banker

- Financial Advisor

- Risk manager

- Actuary

- Bookkeeper

- Human resource manager

- Business Consultant

- Investment broker

- Budget analyst

- Business operation manager

The Skillschool PGP in Banking, Financial Services and Insurance course requires its prospective students to have:

- Bachelor’s degree in a relevant field with a minimum of 50 per cent.

- Must have a minimum of 50 per cent in the X and XII grades.

- Graduation final year/ semester students. Awaiting results may also apply.

- Must be between 21-28 years of age.

- Working professionals may also apply.

The PGP in Banking Financial Services and Insurance course at Skillschool is an accelerated program that spans 4 months only.

In the event of you missing your live online class, you may access the live recorded lectures and sessions on the student’s LMS (Learning System Management) Portal.

Graduates in relevant fields like Economics, Commerce, Mathematics, Statistics, etc. are eligible to pursue the PGP in Banking Financial Services and Insurance. Candidates must also have a fair knowledge of the computer basics. SkillSchool offers and designed courses catering to aspirants at all levels from basic to advanced to ensure students get the most out of the course and become job-ready.

Banking Articles and Blogs

Explore our expansive learner’s resources and gain insights about the latest banking sector trends and topics spanning diverse disciplines.